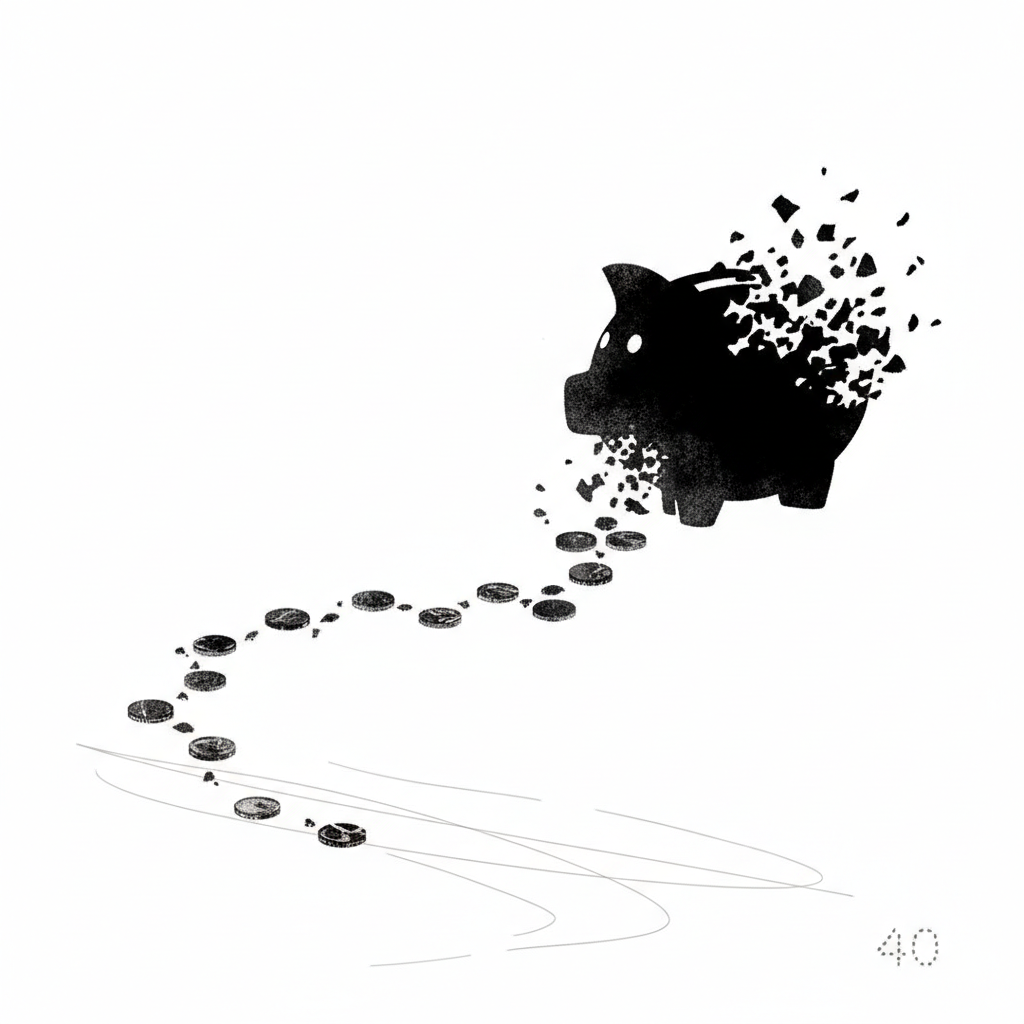

In our technologically advanced world of 2026, where electric vehicles (EVs) are becoming a norm, advanced driving assistance systems (ADAS) offer unparalleled convenience, and a multitude of digital subscriptions govern everything from entertainment to vehicle features, financial management has never been more intricate. While we often meticulously budget for large purchases and significant recurring bills, it’s the seemingly insignificant, small expenses—the daily coffee, the forgotten subscription, the microtransaction—that quietly, yet relentlessly, erode our financial well-being. This phenomenon, often dubbed "death by a thousand cuts," represents a major, often overlooked, drain on personal finances. Understanding how these accumulated costs impact our wallets is crucial for maintaining financial health in a rapidly evolving economy.

The Psychology of Overlooking Small Expenses

Our brains are wired to prioritize large, impactful events. This cognitive bias often leads us to neglect minor, frequent expenditures:

- Anchoring Bias: We tend to anchor our financial attention to big-ticket items like a mortgage payment, car loan, or major investment. A $5 coffee seems negligible in comparison.

- Mental Accounting: We often categorize money differently. Funds allocated for "daily treats" or "discretionary spending" feel less important than those for "savings" or "bills," making it easier to justify small indulgences.

- Lack of Perceived Impact: A single $2 charge feels insignificant. The cumulative effect over weeks, months, or years is hard to visualize without active tracking.

- Instant Gratification: Many small expenses offer immediate pleasure or convenience, making them difficult to resist, especially in a consumer-driven society.

“By 2026, the digital age has made small expenses both easier to incur and harder to track. The insidious creep of micro-costs is a silent thief of wealth.”

Modern Manifestations of Accumulated Costs (2026 Context)

The digital economy and evolving consumer habits have introduced new avenues for these small expenses to accumulate:

- Digital Subscriptions: Beyond core streaming services, there are gaming passes, premium app features, fitness programs, and even niche content platforms. Each might be $5-$20 a month, but a handful easily adds up.

- "Car-as-a-Service" Fees: Modern vehicles, especially EVs equipped with ADAS, increasingly offer features via subscription. A monthly fee for heated seats, a performance boost, or advanced connectivity might seem minor individually, but they are recurring costs that add up over a year.

- Food & Drink Convenience: Daily premium coffees, frequent bottled waters, or snack purchases from convenience stores. While often just $2-$7 per item, these habits can amount to hundreds, if not thousands, annually.

- Food Delivery Fees: The convenience of food delivery platforms comes with charges beyond the meal price: delivery fees, service fees, and tips. A typical order can add $10-$20 in these fees.

- Microtransactions & In-App Purchases: For mobile games, digital content, or online services, these small, often sub-$10 purchases can become a regular, unbudgeted expenditure.

- Hidden Banking Fees: ATM fees, foreign transaction fees (especially when traveling and using cards without waivers), or overdraft charges. While sporadic, they are pure loss.

Quantifying the Impact: A Hypothetical Annual Drain (2026)

Let's illustrate how easily these small amounts can become significant over a year for a typical individual in 2026:

| Expense Item | Daily/Weekly/Monthly Cost | Annual Cost (Estimated) |

|---|---|---|

| Premium Coffee (5x/week) | $5/day = $100/month | $1,200 |

| Streaming Service Subscription | $20/month | $240 |

| EV Performance Boost Subscription (seasonal average) | $37.50/month | $450 |

| Food Delivery Fees (2x/week, avg $7/order) | $56/month | $672 |

| Total Accumulated | N/A | $2,562 |

Note: These figures are illustrative for 2026 and can vary significantly based on individual habits, region, and specific service providers.

This annual sum of $2,562 could represent a significant contribution to an emergency fund, a down payment on a new EV, a substantial investment, or a dream vacation. It's the opportunity cost of these small expenses that truly constitutes the "big loss."

Strategies to Control Accumulated Costs

Reclaiming control over these insidious drains requires a conscious effort:

- Track Every Dollar: Use budgeting apps or spreadsheets to log all your spending. Seeing where your money actually goes is the most powerful eye-opener.

- Regular Subscription Audits: Periodically review all your active subscriptions. Cancel those you no longer use or value.

- Automate Savings: Set up automatic transfers of a fixed amount to your savings or investment accounts immediately after payday. This ensures you "pay yourself first."

- Implement a "Cooling-Off" Period: For non-essential small purchases, wait 24 hours before buying. This often reveals that the item wasn't truly needed.

- Calculate Annual Impact: For recurring small habits (like daily coffee), calculate their annual cost. This often provides the motivation needed to make a change.

- Seek Alternatives: Can you make coffee at home? Drive to pick up food instead of delivery? Use free versions of apps?

Conclusion

The effect of accumulated small expenses is a pervasive financial challenge in 2026, often hidden in plain sight amidst the complexities of modern spending, from EVs to ADAS and subscriptions. While individual micro-costs seem insignificant, their collective impact can be substantial, preventing us from achieving larger financial goals. By developing an acute awareness of where our money flows and implementing proactive management strategies, we can plug these small leaks before they create a flood. To gain a truly comprehensive understanding of all potential expenses, both large and small, and their long-term impact on your financial health, it is always recommended to use a "Total Cost of Ownership" (TCO) calculator for all significant purchases and recurring expenses.