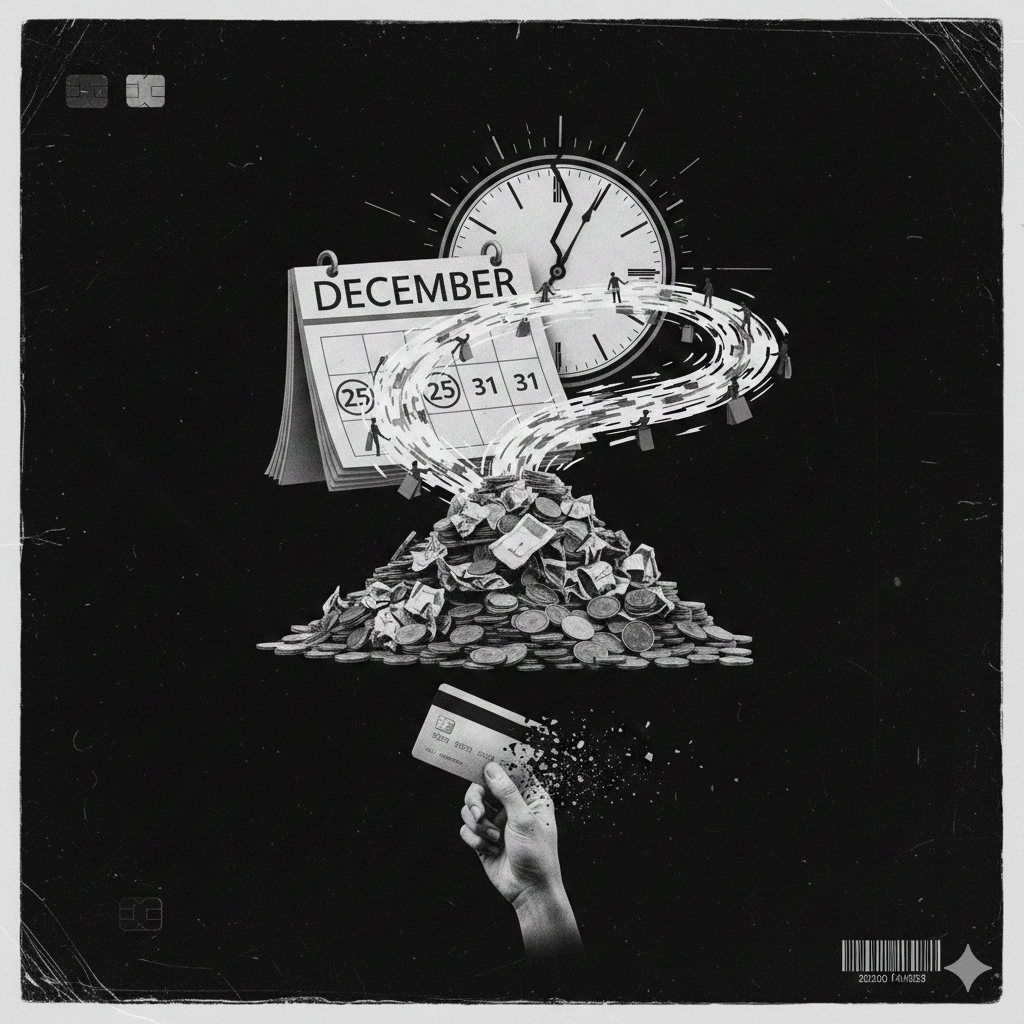

As the year 2026 draws to a close, a familiar phenomenon sweeps across households globally: a significant surge in spending, often leading to what many term "December financial panic." Despite the widespread adoption of budgeting apps and increased financial literacy, the allure of the holiday season proves incredibly powerful. This isn't just about celebratory cheer; it's a complex interplay of deep-rooted psychological triggers, aggressive retail strategies, and a unique set of seasonal expenses—exacerbated by modern trends like electric vehicles (EVs), advanced driving assistance systems (ADAS), and a plethora of digital subscriptions—that collectively conspire to lighten wallets significantly before the New Year. Understanding why we tend to overspend in December is the first critical step toward gaining financial control.

The Psychology Behind Holiday Overspending

Our heightened spending in December is rooted in several powerful psychological factors:

- Emotional Spending and Nostalgia: The holiday season is heavily laden with emotional significance. We often spend to recreate cherished childhood memories, express love, or alleviate stress, leading to purchases driven by sentiment rather than necessity.

- Social Pressure and Comparison: There's an undeniable pressure, often amplified by social media (even by 2026 standards), to give impressive gifts, host elaborate gatherings, and participate in festive activities. This can lead to keeping up with others, causing competitive spending.

- "Treat Yourself" Mentality: The end of the year often brings a sense of accomplishment or the feeling that one deserves a reward. This mindset, sometimes fueled by year-end bonuses, can justify extravagant purchases or luxury items.

- Fear of Missing Out (FOMO): Pervasive in our digital age, FOMO drives consumers to participate in every holiday event, purchase every trending gift, or subscribe to every new seasonal service, fearing regret if they don't.

“By 2026, December is less a month and more a state of financial mind, where the joy of giving often clashes with the reality of our budgets.”

Key Drivers of December Expenses

Beyond psychology, several practical categories see exponential growth in spending:

- Gifts: The quintessential holiday expense. Retailers begin aggressive sales campaigns months in advance, peaking with Black Friday and Cyber Monday. By 2026, this includes physical goods, digital subscriptions (e.g., streaming, gaming, even advanced vehicle features temporarily unlocked), and experience vouchers. The average household spending on gifts remains consistently high.

- Food and Drink: Holiday feasts, parties, and family gatherings lead to significantly larger grocery bills, often including premium or specialty items. Dining out becomes more frequent, with restaurants often introducing pricier festive menus or minimum spends.

- Travel: Peak season for travel. Airfares, hotel rates, and public transportation costs surge. For EV owners, while home charging remains economical, extensive holiday road trips often necessitate reliance on public fast chargers, which can be more expensive, especially if demand-based pricing is in effect. Vehicle maintenance (like tire checks for winter travel) also becomes more critical.

- Decorations and Home Entertaining: Annual refresh of holiday decorations, special tableware, and home improvements to host guests add to the financial burden.

Emerging and Hidden Costs in the 2026 Context

Modern technology introduces new, sometimes subtle, avenues for increased December spending:

- Digital Subscriptions: New streaming services for holiday content, gaming passes for children, or even trial periods for premium vehicle features (like enhanced ADAS or performance boosts in EVs) convert to paid subscriptions if not canceled.

- Connected Car Services: Modern EVs and vehicles with extensive ADAS often come with connectivity subscriptions for navigation, remote services, and over-the-air (OTA) updates. These might be bundled with the initial purchase but become recurring expenses after a trial period, potentially catching owners off guard at year-end.

- Increased Utility Bills: Colder weather in many regions means higher heating costs. For EV owners, pre-conditioning the battery and cabin in winter also draws significant energy, contributing to higher electricity bills.

- Cybersecurity Concerns: With increased online shopping and digital transactions during the holidays, there's a heightened risk of cyber threats, potentially leading to increased spending on security software or identity protection services.

Typical December Spending Breakdown (2026 Estimates)

Here’s an illustrative overview of how a typical household might allocate its December budget:

| Category | Estimated Spending Range |

|---|---|

| Gifts (Physical & Digital) | $450 - $1,200+ |

| Food & Drink (Groceries & Dining Out) | $250 - $700 |

| Travel & Transport (Fuel/Charging, Accommodation) | $200 - $1,000+ |

| Entertainment & Social Events | $100 - $350 |

| Decorations, Utilities & Subscriptions | $70 - $300 |

| Total Estimated December Spending | $1,070 - $3,550+ |

Note: These figures are illustrative for 2026 and depend heavily on household income, lifestyle choices, and geographic location.

Strategies to Control December Spending

Mitigating the financial panic requires proactive planning:

- Start Early: Begin saving and planning for holiday purchases months in advance.

- Create a Detailed Budget: Allocate specific amounts for each category and stick to them. Use budgeting apps to track spending in real-time.

- Prioritize: Decide what aspects of the holidays are most important to you and focus your spending there, cutting back on less critical areas.

- Avoid Impulse Buys: Be mindful of aggressive marketing tactics and consider a "24-hour rule" for non-essential purchases.

- Utilize Rewards and Discounts: Maximize credit card rewards, loyalty points, and sales events throughout the year.

Conclusion

December's tendency to trigger financial panic is a well-established pattern, driven by a blend of psychological pressures and increased seasonal expenses. In the tech-infused landscape of 2026, new costs associated with digital subscriptions and connected vehicle features further complicate the financial picture. By understanding these dynamics and implementing proactive budgeting strategies, you can transform December from a month of financial stress into a period of genuine joy and celebration, free from post-holiday regret. Just as a "Total Cost of Ownership" (TCO) calculator provides a holistic view of your vehicle expenses, applying similar foresight to your holiday spending ensures long-term financial health.